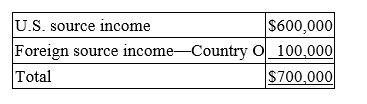

Jovar Inc., a U.S. multinational, began operations this year. Jovar had pretax U.S. source income and foreign source income as follows.  Jovar paid $50,000 income tax to Country O. Compute Jovar's U.S. tax liability if it takes the foreign tax credit.

Jovar paid $50,000 income tax to Country O. Compute Jovar's U.S. tax liability if it takes the foreign tax credit.

Definitions:

Options Traded

Financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at an agreed-upon price within a certain period of time.

Right to Buy

A privilege granted to shareholders or options holders to purchase additional shares within a company at a predetermined price and time.

All-Equity Firm

A company that finances its operations and investments solely through equity without any debt financing.

Exercise Price

The price at which the holder of an options contract may buy (call) or sell (put) the underlying security.

Q20: Jovar Inc., a U.S. multinational, began operations

Q21: Sissoon Inc. exchanged a business asset for

Q30: This year, Haven Corporation granted a nonqualified

Q37: A corporation that owns more than $10

Q40: Mr. and Mrs. Borem spent $1,435 for

Q49: A partnership is an unincorporated business activity

Q68: Which of the following is excluded from

Q68: Which of the following statements about the

Q98: TasteCo, Inc. reported $210,500 of taxable income

Q102: In today's tax environment, the opportunity for