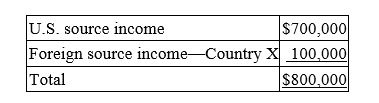

Global Corporation, a U.S. multinational, began operations this year. Global had pretax U.S. source income and foreign source income as follows.  Global paid $25,000 income tax to Country X. What is Global's U.S. tax liability if it takes the foreign tax credit?

Global paid $25,000 income tax to Country X. What is Global's U.S. tax liability if it takes the foreign tax credit?

Definitions:

Scarce Resources

Items that are limited in availability and are necessary for survival, influencing competition and economic dynamics.

Ethnic Minority Groups

Ethnic minority groups are populations differentiated from the majority population based on cultural, national, tribal, racial, or religious characteristics.

Identity

The sense of self or group, including aspects such as nationality, ethnicity, culture, gender, and profession, defining who someone is.

Q1: New companies and those with volatile earnings

Q2: Bisou Inc. made a $48,200 contribution to

Q17: Mr. and Mrs. Reece couldn't complete their

Q21: Mr. and Mrs. Upton's marginal tax rate

Q37: In which of the following is not

Q47: Which of the following statements regarding filing

Q52: A taxpayer must have owned and lived

Q64: A corporation's minimum tax credit can reduce

Q92: Toffel Inc. exchanged investment land subject to

Q94: Miss Blixen's regular income tax is $77,390,