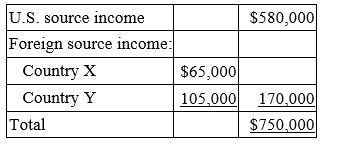

Many Mountains, Inc. is a U.S. multinational corporation. This year, it had the following income.  Many Mountains paid $15,000 income tax to Country X and $28,500 income tax to Country Y. Compute Many Mountains' allowable foreign tax credit.

Many Mountains paid $15,000 income tax to Country X and $28,500 income tax to Country Y. Compute Many Mountains' allowable foreign tax credit.

Definitions:

Heuristics

Simple, efficient rules, often learned or instinctive, that help in making decisions, forming judgments, or solving problems.

Behavioral Economists

Economists who study how psychological, social, cognitive, and emotional factors affect economic decisions of individuals and institutions.

Rational Calculations

The process of making decisions based on logical reasoning and quantitative analysis to achieve the most favorable outcome.

Heuristics

Mental shortcuts or rules of thumb that simplify decision-making processes, often utilized in situations involving uncertainty or complexity.

Q12: Mr. and Mrs. Bennett file a joint

Q32: When the personal holding company tax was

Q54: An extension of the time to file

Q77: Grantly Seafood is a calendar year taxpayer.

Q77: Drake Partnership earned a net profit of

Q79: Orange, Inc. is a calendar year partnership

Q88: In determining the portion of a firm's

Q101: Employees who save for retirement through an

Q103: Mr. Andrews is age 58, legally blind,

Q109: Which of the following statements about Section