Multiple Choice

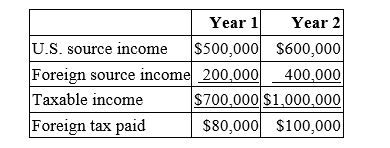

Jenkin Corporation reported the following for its first two taxable years.  Calculate Jenkin's U.S. tax liability for Year 2.

Calculate Jenkin's U.S. tax liability for Year 2.

Definitions:

Related Questions

Q23: Doctors Inc. is a corporation owned by

Q24: In order to be claimed as a

Q51: Gains realized on the sale of personal

Q55: The dividends-received deduction is equal to 80%

Q64: Alimony payments are included in the recipient's

Q65: Taxpayers include a maximum of 85% of

Q67: Jackie contributed $60,000 in cash to a

Q78: Mr. and Mrs. Stern reported $312,440 alternative

Q79: Which of the following statements regarding Schedule

Q86: Mrs. Lee, age 70, withdrew $10,000 from