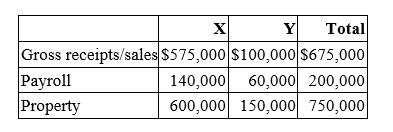

Origami does business in states X and Y. State X uses an equally-weighted three-factor apportionment formula and has a 4 percent state tax rate. State Y uses an apportionment formula that double-weights the sales factor and has a 6 percent tax rate. Cromwell's taxable income, before apportionment, is $3 million. Its sales, payroll, and property information are as follows.

a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

b. State Y is considering changing its apportionment formula to a single sales factor. Given its current level of activity, would such a change increase or decrease Origami's state income tax burden? Provide calculations to support your conclusion

Definitions:

Local Responsiveness

Adjusting or creating an approach to meet the differentiated needs of local markets, of local customers, of local stakeholders such as government officials and employees, and of suppliers and distributors.

Adjusting Approach

Adapting strategies or behaviors to better align with the current context or to meet the needs of different situations or stakeholders.

Local Markets

Marketplaces within a specific geographical area where businesses sell goods and services directly to consumers in the community.

Low-Cost Leadership

A strategy that aims at becoming the lowest-cost producer in an industry to gain a competitive advantage.

Q3: The unearned income Medicare contribution tax applies

Q3: Charlie is single and provides 100% of

Q8: Mr. Dilly has expenses relating to a

Q26: IPM Inc. and Zeta Company formed IPeta

Q39: Ted and Alice divorced this year. Pursuant

Q45: Multi-state businesses can reduce their overall tax

Q49: A partnership is an unincorporated business activity

Q64: Mr. and Mrs. Owens moved from San

Q93: Which of the following statements about an

Q104: Logan, an Indiana corporation, conducts its international