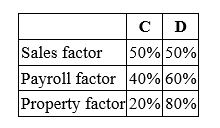

Albany, Inc. does business in states C and D. State C uses an apportionment formula that double-weights the sales factor; state D apportions income using an equally-weighted three-factor formula. Albany's before tax income is $3,000,000, and its sales, payroll, and property factors are as follows. Calculate Albany's income taxable in each state.

Calculate Albany's income taxable in each state.

Definitions:

Toronto District School Board

The largest school board in Canada that oversees public education in the city of Toronto.

2008

A year marked by significant global events including the start of the Great Recession and the election of Barack Obama as the 44th President of the United States.

Environmental Influences

External factors, including social, cultural, and physical environments, that can affect individuals' behaviors, decisions, and health.

Genetic Influences

The contribution of genes to the development of traits and behaviors in organisms, including humans.

Q52: Mr. Marshall was employed by IMP Inc.

Q52: Kyrsten Haas expects her S corporation to

Q58: Nontaxable exchanges typically cause a temporary difference

Q60: Most tax credits for which a corporate

Q66: Mr. and Mrs. Jelk file a joint

Q67: Ruth Anne, a single taxpayer, reported $152,600

Q69: In 2013, Mrs. Owens paid $50,000 for

Q86: Section 482 of the Internal Revenue Code

Q96: Which of the following statements concerning qualified

Q120: The sale of business inventory always generates