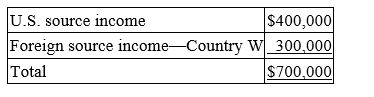

San Carlos Corporation, a U.S. multinational, had pretax U.S. source income and foreign source income as follows.  San Carlos paid $100,000 income tax to Country W. Calculate San Carlos' tax savings if it takes a foreign tax credit rather than deducting this tax.

San Carlos paid $100,000 income tax to Country W. Calculate San Carlos' tax savings if it takes a foreign tax credit rather than deducting this tax.

Definitions:

Double Helix

The structure formed by double-stranded molecules of nucleic acids such as DNA. It is often described as a twisted ladder shape.

Conception

The process in which a sperm fertilizes an egg, leading to the start of a pregnancy.

Union of Ovum and Sperm

The process of fertilization where a sperm cell combines with an ovum (egg) to form a zygote, the first stage in the development of a new organism.

Double Helix

The structure of DNA, characterized by two spiraling strands formed by base pairs bound together and twisted around each other.

Q18: Orchid Inc., a U.S. multinational with a

Q40: Mr. Sherman incurred $7,000 of employment-related business

Q55: Mr. and Mrs. Holt made no taxable

Q64: Beverly earned a $75,000 salary and recognized

Q73: An individual's taxable income equals adjusted gross

Q77: Lana, an employee of Compton University, paid

Q79: Which of the following statements about the

Q88: Ten years ago, Elaine paid $10 per

Q98: GAAP-based consolidated financial statements include only income

Q106: Two years ago, James loaned $60,000 to