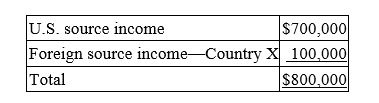

Global Corporation, a U.S. multinational, began operations this year. Global had pretax U.S. source income and foreign source income as follows.  Global paid $25,000 income tax to Country X. What is Global's U.S. tax liability if it takes the foreign tax credit?

Global paid $25,000 income tax to Country X. What is Global's U.S. tax liability if it takes the foreign tax credit?

Definitions:

Separate Record

An accounting practice where transactions are recorded individually, allowing for clearer tracing and tracking of specific financial movements or activities.

Factory Overhead Account

This refers to an account that accumulates all the indirect costs associated with the manufacturing process, excluding direct materials and direct labor.

Credit Balance

An account balance that indicates the amount a company owes to others, or it can represent a situation where a customer has paid more than the currently owed amount.

Process Cost Accounting

A method of accounting that accumulates and assigns costs to units of product in large quantities, where the products are indistinguishable from each other.

Q21: For federal income tax purposes, a taxpayer

Q24: Under the U.S. tax system, a domestic

Q24: If a business is formed as an

Q26: Mr. Bennett is a professional tax return

Q34: William took out a $740,000 mortgage to

Q57: For federal income tax purposes, a taxpayer

Q77: Material participation in a business activity means

Q97: If an investor sells some of the

Q101: Last year, Mr. Margot purchased a limited

Q105: Mr. and Mrs. Meredith own a sole