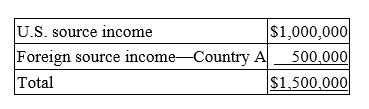

Fleming Corporation, a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Fleming paid $50,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $50,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Definitions:

White-Collar

Pertaining to workers or jobs characterized by office or administrative work, as opposed to blue-collar jobs that involve manual labor.

Street Crimes

Criminal activities that occur in public places, typically involving theft, assault, or vandalism.

Expensive

Characterized by high cost or price; something that requires a significant amount of money to purchase or maintain.

Merton's Strain Theory

A sociological theory that explains deviance in terms of the pressure individuals feel to achieve socially accepted goals by legitimate means.

Q2: Carman wishes to exchange 10 acres of

Q11: A family partnership can be used to

Q14: Gerry is the sole shareholder and president

Q36: Both corporate and individual taxpayers may be

Q45: A husband and wife are allowed only

Q45: Multi-state businesses can reduce their overall tax

Q53: Mr. Rex had his car stolen this

Q67: LiO Company transferred an old asset with

Q76: Alan is a general partner in ADK

Q87: Lansing Corporation, a publicly held company with