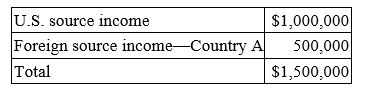

Fleming Corporation, a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Fleming paid $200,000 income tax to Country

Fleming paid $200,000 income tax to Country

Definitions:

Demand Characteristics

Cues in an experiment that suggest to participants what behavior is expected, potentially influencing the outcomes of that experiment.

Falsifiable

A principle that a hypothesis or theory must be capable of being proven false in order to be considered scientific.

Testable Predictions

Hypotheses or statements that can be verified or falsified through experimentation or observation.

Principle of Parsimony

A principle suggesting that one should not make more assumptions than the minimum needed to explain something.

Q4: Harold Biggs is provided with $200,000 coverage

Q5: In 1996, Mr. Exton, a single taxpayer,

Q26: Galaxy Corporation conducts business in the U.S.

Q36: The United States has jurisdiction to tax

Q40: Mr. and Mrs. Stimson incurred $3,937 of

Q56: Which of the following statements concerning the

Q60: Which of the following statements regarding a

Q85: A fire destroyed business equipment that was

Q87: Which of the following statements concerning the

Q90: On January 1 of this year, Conrad