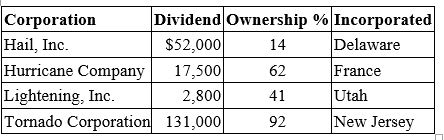

Thunder, Inc. has invested in the stock of several corporations and has $500,000 operating income before dividends.  Calculate Thunder's dividends-received deduction and taxable income:

Calculate Thunder's dividends-received deduction and taxable income:

Definitions:

Internal Supply

The availability of existing employees within an organization who can be trained or promoted to fill vacancies.

Human Resources

The department within an organization that is responsible for hiring, training, managing, and retaining employees.

Markov Analysis

A statistical technique used to predict future states of a system based on its current state and known transition probabilities, often applied in workforce planning and decision making.

Talent Management

The ongoing process of identifying, hiring, developing, and retaining employees who are considered to be of high value to an organization.

Q2: Bisou Inc. made a $48,200 contribution to

Q39: A major advantage of an S corporation

Q49: Five years ago, Q&J Inc. transferred land

Q52: Which of the following is not a

Q53: Mr. and Mrs. Reid reported $435,700 ordinary

Q57: Brenda sold investment land for $200,000 in

Q70: The deemed paid foreign tax credit treats

Q71: The foreign tax credit can reduce a

Q71: Bryan Houlberg expects his C corporation to

Q102: Transfer pricing issues arise:<br>A) When tangible goods