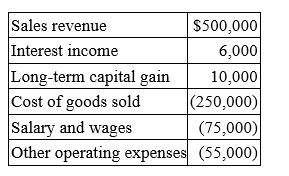

Waters Corporation is an S corporation with two equal shareholders, Mia Jones and David Kerns. This year, Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year. Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Waters distributed $25,000 to each of its shareholders during the year. Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Definitions:

Advanced Technology

Cutting-edge or highly developed tools, equipment, and processes that offer superior performance or capabilities.

Basic Skills

Basic skills are fundamental abilities such as reading, writing, math, and communication that individuals need to function effectively in society and the workplace.

Malcolm Baldrige

Namesake of the Malcolm Baldrige National Quality Award, recognizing U.S. organizations for performance excellence.

National Quality Award

An accolade given to organizations that demonstrate outstanding quality management and operational excellence.

Q6: Mr. and Mrs. Eyre own residential rental

Q16: Which of the following items might an

Q23: Recent tax legislation reducing the individual tax

Q30: Which of the following statements regarding controlled

Q40: Mr. and Mrs. Borem spent $1,435 for

Q40: Pyle Inc., a calendar year taxpayer, generated

Q45: A husband and wife are allowed only

Q73: A corporation can use the installment sale

Q88: Grantly Seafood is a calendar year taxpayer.

Q89: Tanner Inc. owns a fleet of passenger