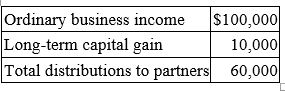

Mutt and Jeff are general partners in M&J Partnership and share profits and losses equally. Partnership operations for the current tax year were:  Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000. What is his basis at the beginning of next year?

Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000. What is his basis at the beginning of next year?

Definitions:

Departmental Analysis

An evaluation process aimed at understanding the functions, performance, and needs of different business units within an organization.

Per-Employee Expenditures

The amount of money spent by an organization for each employee, which can cover salaries, benefits, training costs, and other related expenses.

Employee Productivity

The measurement of the efficiency of an employee or group of employees in producing goods or services.

Flatter Organizational Structures

An organizational model with fewer hierarchical levels, intended to promote better communication and faster decision-making.

Q6: Armond earned $10,000 of profit from a

Q9: Corporations report their taxable income and calculate

Q15: John's share of partnership loss was $60,000.

Q24: Dender Company sold business equipment with a

Q30: Alice is a partner in Axel Partnership.

Q59: Nixon Inc. transferred Asset A to an

Q72: Zeron Inc. generated $1,349,600 ordinary income from

Q75: According to your textbook, business managers prefer

Q78: Pim Inc. operates a business with a

Q79: A taxpayer who realizes a loss on