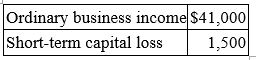

Alex is a partner in a calendar year partnership. His partnership Schedule K-1 for the current tax year showed the following:  Alex has a $7,000 loss carryforward from the partnership last year, which he could not deduct because of the basis limitation. What is his tax basis in his partnership interest at the end of the current tax year?

Alex has a $7,000 loss carryforward from the partnership last year, which he could not deduct because of the basis limitation. What is his tax basis in his partnership interest at the end of the current tax year?

Definitions:

Pharmacy Authorization

The process by which a pharmacy obtains approval to dispense a prescribed medication to the patient, often requiring verification of medical necessity from a healthcare provider.

Licensed Practitioner

A professional who has received the necessary license to practice in their specific field of expertise.

Emergency Room

A medical treatment facility specializing in emergency medicine, where patients with acute illnesses or injuries are treated.

Distressing Pain

Severe discomfort or ache that negatively affects a person's well-being and quality of life.

Q13: NLT Inc. purchased only one item of

Q22: Norwell Company purchased $1,413,200 of new business

Q50: For the taxable year in which a

Q54: An accrual basis taxpayer must account the

Q56: Valley Inc. incurred a $71,400 net operating

Q67: The sales factor in the UDITPA state

Q75: According to your textbook, business managers prefer

Q87: Dividends-received deductions generally are not allowed for

Q88: In computing taxable income, an individual is

Q122: The gain or loss recognized on any