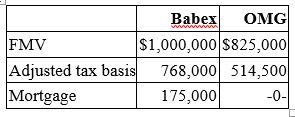

Babex Inc. and OMG Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Definitions:

Q7: A business generates profit of $100,000. The

Q8: Mr. Dilly has expenses relating to a

Q21: Taxpayers may adopt the cash receipts and

Q36: Accurate measurement of taxable income is the

Q62: Which of the following statements concerning MACRS

Q68: Franton Co., a calendar year, accrual basis

Q84: Which of the following business expenses always

Q85: Which of the following statements about the

Q90: On January 1 of this year, Conrad

Q91: Which of the following statements regarding the