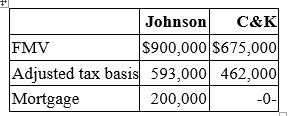

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Definitions:

Brick-and-mortar

Refers to a traditional business that operates in a physical store or building rather than online.

Purely Physical

Pertaining exclusively to the material or tangible aspects of something, devoid of any digital, virtual, or intangible components.

Freemium

A business model where basic services are provided free of charge while more advanced features must be paid for.

Subscription

An arrangement to receive products or services, such as publications or software, on a regular basis by paying a fee.

Q6: According to the assignment of income doctrine,

Q12: Which of the following businesses can't use

Q13: The revenue agent who audited the Form

Q19: Corporations, LLCs, and partnerships are all taxable

Q21: Twelve years ago, Mr. and Mrs. Bathgate

Q25: Repair costs incurred to keep a tangible

Q37: A firm's choice of taxable year is

Q59: International tax treaties generally allow a government

Q73: Which of the following statements regarding limited

Q96: The foreign tax credit is available only