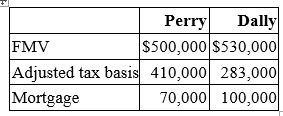

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Definitions:

Pesticides

Chemical substances used to kill or control pests, including insects, rodents, fungi, and unwanted plants (weeds).

Insect Control

Insect control refers to the methods and practices used to manage and reduce pest insect populations to protect crops, human health, and the environment.

Sterilization

The process of making something free from bacteria or other living microorganisms, often through heat or chemical means.

PMRA

Pest Management Regulatory Agency, the Canadian government agency responsible for the regulation of pesticides and pest management strategies.

Q19: A business generates profit of $100,000. The

Q40: Which of the following entities is not

Q46: Mrs. Brinkley transferred business property (FMV $340,200;

Q49: Which of the following is not a

Q77: Drake Partnership earned a net profit of

Q85: For tax purposes, income is recognized when

Q86: At least three corporations are required to

Q88: For a consolidated group of corporations, Schedule

Q107: Poole Services, a calendar year taxpayer, billed

Q110: Which of the following intangible assets is