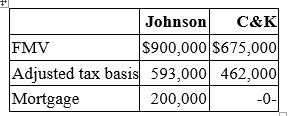

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Definitions:

Mean

The mean of a number set, determined by dividing the sum of all the values by the total count of values.

Interquartile Range

A measure of variability that describes the range within which the middle 50% of a data set lies, calculated as the difference between the 75th and 25th percentiles.

Variability

Variability refers to the extent to which data points in a distribution differ from each other and from the mean of the distribution.

First Quartile

The median of the lower half of a dataset, also called the lower quartile.

Q27: O&V sold an asset with a $78,300

Q34: Which of the following capitalized cost is

Q44: Delta Inc. generated $668,200 ordinary income from

Q53: William is a member of an LLC.

Q54: Transfer prices cannot be used by U.S.

Q58: Fantino Inc. was incorporated in 2013 and

Q62: Abada Inc. has a $925,000 basis in

Q85: For tax purposes, income is recognized when

Q92: Which of the following statements regarding the

Q105: Mr. and Mrs. Meredith own a sole