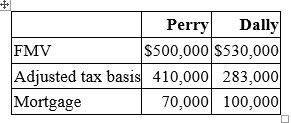

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Definitions:

Purchase Price

This is the amount of money paid to buy a good, service, or financial asset.

Straight-Line Depreciation

A strategy for spreading out the expenditure of a tangible asset over the duration of its usefulness in uniform annual amounts.

Break-Even Lease Payment

The lease payment amount at which the cost of leasing equals the cost of purchasing the asset.

Financing Rate

The interest rate charged by lenders for borrowing money or the cost of obtaining finance.

Q18: A corporate taxpayer would prefer a $50,000

Q20: Westside, Inc. owns 15% of Innsbrook's common

Q31: Debbie is a limited partner in ADK

Q31: The after-tax cost of a dollar of

Q33: This year, Garfield Inc. generated a $25,000

Q65: Which of the following statements concerning the

Q67: Cosmo Inc. purchased an asset costing $67,500

Q87: Which of the following statements concerning the

Q91: Which of the following statements regarding the

Q98: TasteCo, Inc. reported $210,500 of taxable income