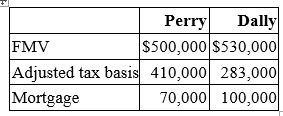

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Definitions:

Mixers

Devices or machines used for combining materials or ingredients together in various processes, including cooking or industrial manufacturing.

Cakes

Cakes refer to a sweet baked dessert, often layered or decorated, made from ingredients such as flour, sugar, eggs, and butter.

Constant Returns

An economic principle where increasing inputs in production results in a proportional increase in outputs.

Scale

A concept in economics that refers to the level at which a company or economy operates, particularly in terms of production and cost efficiency.

Q7: Which of the following statements regarding a

Q17: This year, Sutton Corporation's before-tax income was

Q22: Which of the following is not primary

Q63: Mann Inc. negotiated a 36-month lease on

Q63: Forward Inc.'s book income of $739,000 includes

Q67: LiO Company transferred an old asset with

Q71: When performing step two of the tax

Q76: Warsham Inc. sold land with a $300,000

Q77: Tonto Inc. has used a calendar year

Q78: Ms. Cregg has a $43,790 basis in