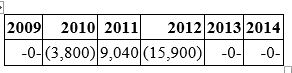

Proctor Inc. was incorporated in 2009 and adopted a calendar year. Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through  In 2015, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

In 2015, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

Definitions:

Explicit Memory

A type of long-term memory involving conscious recollection of previous experiences or information.

Hippocampus

A region of the brain that is associated with memory forming, organizing, and storing.

Amygdala

A part of the brain's limbic system involved in emotion regulation, especially fear and pleasure responses, playing a critical role in forming emotional memories.

Basal Ganglia

A group of structures located deep within the cerebral hemispheres involved in controlling voluntary motor movements, procedural learning, and emotions.

Q7: Which of the following statements regarding a

Q11: Grumond was incorporated on January 1, 2010,

Q14: R&T Inc. made the following sales of

Q31: Sunny Vale Co. reported the following for

Q33: Pratt Inc. reported $198,300 book depreciation on

Q34: Loda Inc. made an $8,300 nondeductible charitable

Q53: William is a member of an LLC.

Q69: Individual shareholders who create a brother-sister controlled

Q71: L&P Inc., which manufactures electrical components, purchased

Q102: Environmental clean-up costs are generally deductible in