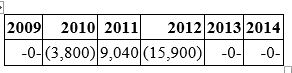

Proctor Inc. was incorporated in 2009 and adopted a calendar year. Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through  In 2015, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

In 2015, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

Definitions:

Q39: Tax avoidance is the reduction of a

Q40: Which of the following statements about implicit

Q45: In 20Y1, Ms. Graves transferred appreciated property

Q48: Mr. and Mrs. Sykes operate a very

Q60: The seller's amount realized on the sale

Q65: Mr. Weller and the Olson Partnership entered

Q67: Jackie contributed $60,000 in cash to a

Q72: Which of the following statements regarding S

Q90: On January 1 of this year, Conrad

Q103: IPM Inc. and Zeta Company formed IPeta