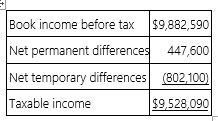

B&B Inc.'s taxable income is computed as follows.  Using a 34% rate, compute B&B's tax expense per books and tax payable.

Using a 34% rate, compute B&B's tax expense per books and tax payable.

Definitions:

Manufacturing Process

A series of steps involving the conversion of raw materials into finished products through various production operations.

Process Costing System

An accounting methodology that accumulates and assigns costs to large volumes of identical or similar units of output.

Direct Materials

Raw materials that are directly traceable to the manufacturing of a specific product.

Journal Entry

A record in the accounting ledger that represents a single transaction and its effect on accounts.

Q2: Which of the following statements regarding tax

Q12: A limited liability company is always taxed

Q30: Acme Inc. is planning a transaction that

Q36: Which of the following statements about marginal

Q38: Company D, which has its home office

Q52: A shareholder in an S corporation includes

Q63: The use of the installment sale method

Q69: Bernard and Leon formed a partnership on

Q101: The principle of conservatism reflected by GAAP

Q102: If an accrual basis taxpayer receives a