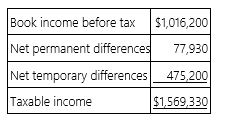

Goff Inc.'s taxable income is computed as follows.  Goff's tax rate is 34%. Which of the following statements is true?

Goff's tax rate is 34%. Which of the following statements is true?

Definitions:

NLRB

National Labor Relations Board, a US federal agency that enforces US labor law in relation to collective bargaining and unfair labor practices.

Collective Bargaining

The process in which working people, through their unions, negotiate contracts with their employers to determine their terms of employment.

Disparate Treatment

A form of discrimination where individuals are treated differently based on prohibited factors such as race, gender, age, etc., in similar situations.

Discriminatory Conduct

Actions or behaviors that unjustly differentiate among individuals, often based on race, age, sex, or religion.

Q3: BugLess Inc, a calendar year, accrual basis

Q15: The majority of state governments raise revenue

Q19: Government J decides that it must increase

Q19: Ms. Kent has $200,000 in an investment

Q44: In 2014, Rydin Company purchased one asset

Q51: Which of the following statements about tax

Q79: Opportunity cost refers to the decrease in

Q89: Kigin Company spent $240,000 to clean up

Q99: D&R Company, a calendar year corporation, purchased

Q102: Yelano Inc. exchanged an old forklift used