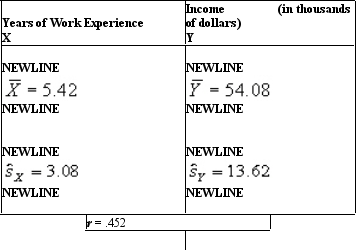

Imagine you are interested in researching the relationship between job experience and income among early-career working professionals.You take a random sample of 32 professionals from the nearest city,and you ask them to report their annual income and submit a resumé outlining their professional experience.You later calculate their years of experience from their resumés.You compute the following information:

If you were to calculate a 95% confidence interval for this correlation coefficient,you would find that it ranges from .11 to .70.How should this interval be interpreted?

Definitions:

Present Value

The modern equivalent value of a future monetary sum or cash flow sequence, with an established return rate.

Interest Rate

The percentage charged on a loan or paid on deposited funds, representing the cost of borrowing or the gain on savings.

Future Value

The value of a current asset at a specified date in the future based on an assumed rate of growth.

Present Value

The current valuation of a future financial sum or stream of payments, factoring in a set rate of return.

Q8: r<sup>2</sup> represent the proportion of variability that

Q30: What is the estimated standard error of

Q52: The test of the chi-square statistic applies

Q76: The standard deviation of the sampling distribution

Q77: A benefit of the nonparametric tests is

Q85: What is meant by the phrase "outlier

Q86: Discuss the sampling distribution of the chi-square

Q91: In a repeated measures design,the components comprising

Q104: In a correlated groups t-test it is

Q114: The Levene test<br>A)evaluates the null hypothesis of