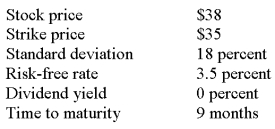

What is the call option premium given the following information?

Definitions:

Expected Rate of Return

The anticipated amount of profit or loss an investment is projected to generate over a specific period, expressed as a percentage.

Portfolio of Risky Securities

A collection of investments that contain a degree of risk, with the expectation of achieving higher returns compared to risk-free assets.

Weighted Sum

A mathematical technique where each component is multiplied by a factor reflecting its importance before their sum is computed.

Variance of Returns

A measure of the dispersion of returns for a given security or market index, typically used to gauge the risk associated with a particular investment.

Q1: A PAC support bond is most similar

Q2: A mortgage pool was created six years

Q11: Which one of the following best defines

Q16: A convertible bond has a $1,000 par

Q25: The risk-free rate is 3.4 percent and

Q29: You are a wheat farmer with a

Q31: A portfolio has a beta of 1.52

Q45: Jeff owns a taxable bond portfolio which

Q57: The Sharpe ratio is best used to

Q65: A 6-month put has a strike price