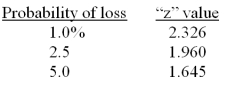

You have a portfolio which has an average return of 12.6 percent. In any given year, you have a 2.5 percent probability of earning either a zero or a negative annual return. What is the approximate standard deviation of your portfolio?

Definitions:

Central Traits

are the key characteristics that define an individual's personality and are thought to be central to how we perceive and describe others.

Secondary Traits

Personality characteristics that are less consistent and more situational, influencing behavior in fewer scenarios compared to primary traits.

Unconditional Positive Regard

A concept in psychology that involves accepting and supporting someone regardless of what they say or do, often used in therapeutic settings.

Self-actualization

A concept in psychology referring to the realization or fulfillment of one's talents and potentialities, considered as a drive or need present in everyone.

Q7: A firm has a price-cash flow ratio

Q8: What is the standard deviation of the

Q23: Which one of the following Arms values

Q45: What is the maximum percentage loss you

Q62: A two-year STRIPS sells at an interest

Q65: Which combination of bond characteristics causes a

Q74: You own 300 shares of ABC stock.

Q76: The series of Fibonacci numbers contains the

Q78: A portfolio consists of the following two

Q97: You purchased two futures contracts on soybeans