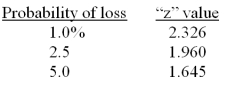

You have a portfolio which has an average return of 12.6 percent. In any given year, you have a 2.5 percent probability of earning either a zero or a negative annual return. What is the approximate standard deviation of your portfolio?

Definitions:

Archegonium

A female reproductive structure found in ferns, mosses, and some conifers and flowering plants, producing a single egg cell for fertilization.

Sporangium

A spore case, found in plants, certain protists, and fungi.

Xylem

The vascular tissue that conducts water and dissolved minerals in plants.

Phloem

The vascular tissue in plants responsible for transporting sugars and other metabolic products downward from the leaves.

Q7: Josh owns 2 call options on Foster

Q27: A portfolio has a 2.5 percent chance

Q40: Which one of the following situations will

Q45: Repricing an employee stock option involves which

Q58: Children's Books, Inc. has net income of

Q73: High Mountain Homes has an expected annual

Q73: A convertible bond has a par value

Q74: Alicia has a portfolio consisting of two

Q75: A company has a price-earnings ratio of

Q94: Which one of the following is the