Multiple Choice

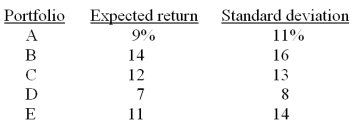

You combine a set of assets using different weights such that you produce the following results.  Which one of these portfolios CANNOT be a Markowitz efficient portfolio?

Which one of these portfolios CANNOT be a Markowitz efficient portfolio?

Definitions:

Related Questions

Q3: Efficient markets tend to exist:<br>A) only when

Q13: A portfolio has a beta of 1.16,

Q25: Which one of the following is a

Q34: Investors who tend to invest too heavily

Q37: The security market line depicts the graphical

Q47: What is the standard deviation of a

Q50: A bond has 8 years to maturity,

Q57: Reed Plastics just announced the earnings per

Q63: Which one of the following will occur

Q76: Which of the following are needed to