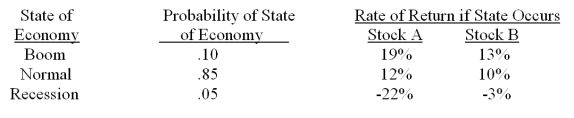

You have a portfolio which is comprised of 20 percent of stock A and 80 percent of stock B. What is the portfolio standard deviation?

Definitions:

Residual Value

The estimated value that an asset will have at the end of its useful life, also known as salvage value.

Net Book Value

The value of an asset as recorded on the balance sheet, calculated as the original cost minus accumulated depreciation and impairments.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in an equal annual amount.

Depreciable Cost

The cost of a fixed asset minus its salvage value, which is the total amount that can be depreciated over its useful life.

Q1: A portfolio has a Treynor ratio of

Q8: A stock has an annual standard deviation

Q21: What is the extra compensation paid to

Q22: Which one of the following is the

Q37: A fully-hedged stock portfolio will have a

Q55: An increase in the retention ratio will:<br>A)

Q62: Louise just purchased 3 call option contracts

Q74: Alfonso Rodriquez has served as the president

Q75: What is the beta of a portfolio

Q78: You have a portfolio which is comprised