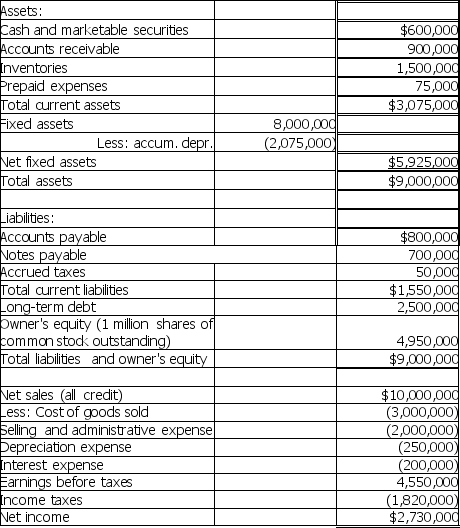

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

-Based on the information in Table 4-1,the OROA is

Definitions:

Beta Coefficient

A measure of a stock's volatility in relation to the overall market, indicating the stock's risk compared to the market average.

Systematic Risk

The risk inherent to the entire market or market segment, indicating how fluctuations in the market can affect individual investments.

Risky Asset

An asset that carries a significant degree of risk of losing all or part of its value.

Total Risk

The complete spectrum of risks associated with an investment, including both systematic and unsystematic risks.

Q28: Intangible assets such as copyrights and goodwill

Q37: In 2000 Jenson Inc.issued bonds with an

Q40: Commercial banks that also provide investment banking

Q45: For a firm to have its securities

Q46: It is important to evaluate a corporate

Q54: An investor is considering two equally risky

Q72: Discuss five limitations to ratio analysis.

Q96: The financial manager most directly responsible for

Q104: The Beta of a T-bill is one.

Q110: Investment A and Investment B both have