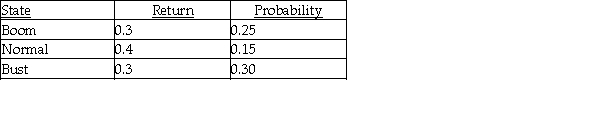

Bay Land,Inc.has the following distribution of returns:  Assuming that these returns are normally distributed,what is the probability that Bay Land,Inc.will return less than 7.25%? Show all work,and clearly explain and state your answer.

Assuming that these returns are normally distributed,what is the probability that Bay Land,Inc.will return less than 7.25%? Show all work,and clearly explain and state your answer.

Definitions:

Current Ratio

An indicator of a company's financial health, showing its capability to settle obligations due within a year by comparing its short-term assets to its short-term liabilities.

Accrued Liabilities

Liabilities recorded on the balance sheet that represent expenses that have been incurred but not yet paid.

Accounts Receivable

Money owed to a company by its customers for goods or services that have been delivered and invoiced but not yet paid for.

TIE Ratio

A financial performance indicator that shows a company's capacity to cover its interest expenses with its current earnings, highlighting its financial health and stability.

Q5: The yield-to-maturity is the discount rate that

Q15: Assume that you have $100,000 invested in

Q23: Last year Gator Getters,Inc.had $50 million in

Q29: Baker Corp.is required by a debt agreement

Q60: You bought a racehorse that has had

Q64: A bond with a $1,000 face value

Q93: Based on the information in Table 4-1,the

Q100: Betty borrows $60,000 at 12 percent compounded

Q104: Stimpson Inc.preferred stock pays a $.50 annual

Q133: Operating profits or EBIT is used to