Essay

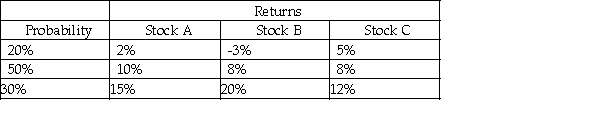

You are considering the three securities listed below.  a.Calculate the expected return for each security.

a.Calculate the expected return for each security.

b.Calculate the standard deviation of returns for each security.

c.Compare Stock A with Stocks B and C.Is Stock A preferred over the others?

Definitions:

Related Questions

Q9: As interest rates,and consequently investors' required rates

Q10: Stocks that plot above the security market

Q25: The rate on T-bills is currently 2%.Environment

Q31: If markets were entirely efficient (perfect),which of

Q49: Other things being equal,investors will value which

Q61: Andre owns a corporate bond with a

Q78: In addition to the information contained in

Q89: Preferred stock is referred to as a

Q108: How much would you be willing to

Q127: An inventory turnover ratio of 7.2 compared