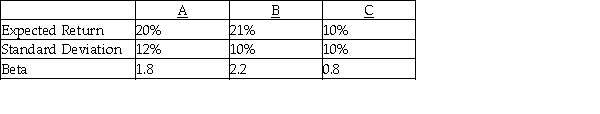

Answer the questions below using the following information on stocks A,B,and C.  Assume the risk-free rate of return is 3% and the expected market return is 12%

Assume the risk-free rate of return is 3% and the expected market return is 12%

a.Calculate the required return for stocks A,B,and C.

b.Assuming an investor with a well-diversified portfolio,which stock would the investor want to add to his portfolio?

c.Assuming an investor who will invest all of his money into one security,which stock will the investor choose?

Definitions:

Human Relations School

A theory in organizational management that emphasizes the importance of interpersonal relationships for increased workplace productivity.

Leadership by Intimidation

A controversial management style where authority is asserted over others through fear, coercion, or threats, rather than respect or inspiration.

Barriers to Pride

Obstacles that prevent individuals or groups from feeling a sense of pride or satisfaction in their achievements.

14 Points

A framework for quality and performance improvement developed by W. Edwards Deming, aimed at transforming the effectiveness of a business.

Q3: Acme Incorporated has a debt ratio of

Q17: Negative historical returns are not possible during

Q24: What is diversifying among different kinds of

Q68: Valley Flights,Inc.has a capital structure made up

Q85: Cost of capital is<br>A)the coupon rate of

Q95: Design Quilters is considering a project with

Q110: Dickerson Corporation's common stock is currently selling

Q114: TellTrue Corporation has preferred stock which paid

Q118: QRM,Inc.'s marginal tax rate is 35%.It can

Q136: Another name for an asset's expected rate