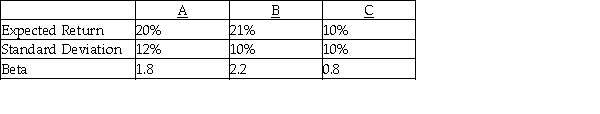

Answer the questions below using the following information on stocks A,B,and C.  Assume the risk-free rate of return is 3% and the expected market return is 12%

Assume the risk-free rate of return is 3% and the expected market return is 12%

a.Calculate the required return for stocks A,B,and C.

b.Assuming an investor with a well-diversified portfolio,which stock would the investor want to add to his portfolio?

c.Assuming an investor who will invest all of his money into one security,which stock will the investor choose?

Definitions:

Business Combinations

Transactions in which one entity gains control over one or more other businesses, including mergers, purchases of net assets, and consolidations.

AASB 3

Refers to the Australian Accounting Standards Board standard that outlines the requirements for the accounting of business combinations, including the recognition and measurement of assets, liabilities, non-controlling interest, and goodwill.

Joint Arrangements

Agreements between two or more parties that establish joint control over economic activities.

Tax Purposes

Refers to reasons or activities related to the calculation and payment of taxes.

Q7: The Western State Company's common stock is

Q19: The goal of most financial managers is

Q39: The stock valuation model D<sub>1</sub>/(r<sub>cs </sub>- g)requires

Q47: You own an ordinary annuity contract that

Q51: The future value of a 10-year ordinary

Q53: An increase in a corporation's marginal tax

Q70: Your son will be attending an expensive

Q86: How managers choose to finance the business

Q123: How can investors reduce the risk associated

Q124: You purchased one share of Sophia Enterprises