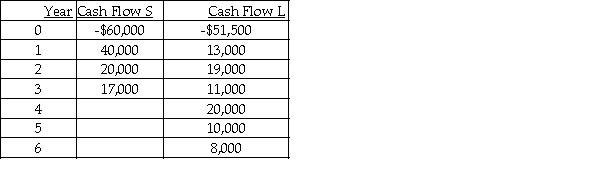

The Dickerson PR Firm is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.  Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

Definitions:

Zero-Coupon Bonds

Debt securities that are issued at a discount and redeemed at face value but do not pay interest during their lifetime.

Immunize

A strategy in finance to shield a portfolio from interest rate movements by aligning the duration of assets and liabilities, thus stabilizing its overall value.

Interest Rate Risk

The potential for investment losses caused by fluctuations in interest rates, affecting debt securities inversely with their prices.

Treasury Bonds

Long-term government securities issued by the U.S. Department of the Treasury with a maturity period typically ranging from 20 to 30 years.

Q6: As part of its expansion project,A.J.Industries Equipment

Q17: If a shareholder cannot attend the corporation's

Q50: The break-even model assumes that selling price

Q73: The cost of preferred stock is equal

Q73: Operating leverage refers to<br>A)financing a portion of

Q93: A corporate bond has a coupon rate

Q104: Stimpson Inc.preferred stock pays a $.50 annual

Q111: Diana Ltd.paid a $2.50 per share dividend

Q115: For a given constant required rate of

Q120: The more fixed-charge securities (such as bonds