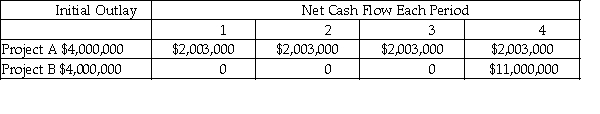

Consider the following two projects:  a.Calculate the net present value of each of the above projects,assuming a 14 percent discount rate.

a.Calculate the net present value of each of the above projects,assuming a 14 percent discount rate.

b.What is the internal rate of return for each of the above projects?

c.Compare and explain the conflicting rankings of the NPVs and IRRs obtained in parts a and b above.

d.If 14 percent is the required rate of return,and these projects are independent,what decision should be made?

e.If 14 percent is the required rate of return,and the projects are mutually exclusive,what decision should be made?

Definitions:

Sustainability

The practice of meeting current needs without compromising the ability of future generations to meet theirs, often focusing on environmental conservation and resource management.

Global Consumption

The total amount of goods and services consumed around the world.

Life Cycle

Refers to the series of stages that an organism, product, or service goes through from its beginning to its end.

Ownership-based Governance

A system where ownership rights are central to decision-making processes and governance structures.

Q3: Alloy Corp.is considering the acquisition of a

Q14: What method is used for calculation of

Q20: Which of the following statements about project

Q27: Preferred stock is less risky than common

Q46: Notes payable and bonds payable are spontaneous

Q46: Kokapeli,Inc.has a target capital structure of 40%

Q63: A project that requires an initial investment

Q72: Financial structure is equal to non-interest bearing

Q110: Maynard Inc.preferred stock pays an annual dividend

Q132: A significant disadvantage of the payback period