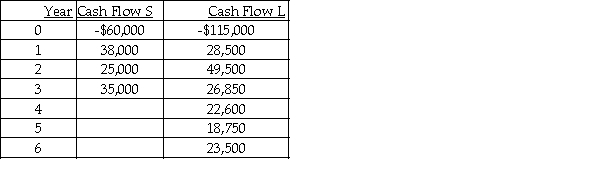

The Meacham Tire Company is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.  The required rate of return on these projects is 14 percent.What decision should be made? As part of your answer,calculate the NPV assuming a replacement chain for Project S,and also calculate the equivalent annual annuity for each project.

The required rate of return on these projects is 14 percent.What decision should be made? As part of your answer,calculate the NPV assuming a replacement chain for Project S,and also calculate the equivalent annual annuity for each project.

Definitions:

Negotiation Performance

The effectiveness and outcome level achieved during negotiations, based on predefined objectives or standards.

Gender Differences

Variations in characteristics, behaviors, and roles traditionally associated with men and women, influenced by social, cultural, and biological factors.

Individual Difference

variations among people in their qualities, abilities, or characteristics.

Large Divisions

Significant differences or disagreements among groups or individuals.

Q14: Business risk refers to the relative dispersion

Q16: A CEO concerned about variability of earnings

Q28: If the sales growth rate is greater

Q59: Analysis of dividend policy begins with the

Q69: Forecasts of revenues and their related expenses

Q72: The DEF Company is planning a $64

Q88: Voellers Upholstery Co.produces inexpensive leather chairs.The average

Q92: The Clydesdale Corporation has an optimal capital

Q116: The payback period may be more appropriate

Q140: Which of the following statements about combined