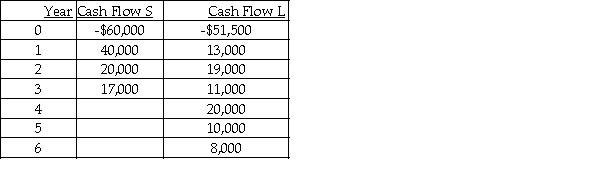

The Dickerson PR Firm is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.  Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

Definitions:

Mark-up

The difference between the cost of a product or service and its selling price, expressed as a percentage of the cost.

Spoilage

Products or materials that have become unfit for sale or use, often leading to financial loss for a business.

Bruising

Physical damage that appears on the skin or body tissues as a result of blunt impact, characterized by discoloration and swelling.

Overhead

The ongoing administrative and operational costs of running a business that are not directly attributable to the production of goods or services.

Q9: The viewpoint that low dividends increase stock

Q42: The final approval of a dividend payment

Q48: Compute the discounted payback period for a

Q73: Sunk costs are<br>A)recoverable.<br>B)incremental.<br>C)not relevant in capital budgeting.<br>D)not

Q85: Assuming no corporate taxes,the independence hypothesis suggests

Q110: Maynard Inc.preferred stock pays an annual dividend

Q122: When several sign reversals in the cash

Q130: All of the following are sufficient indications

Q142: A bond will sell at a premium

Q147: The control hypothesis suggests that shareholders prefer