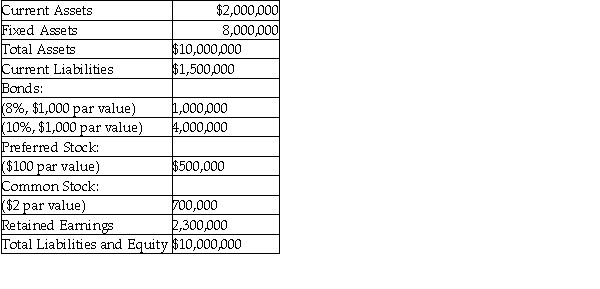

The MAX Corporation is planning a $4,000,000 expansion this year.The expansion can be financed by issuing either common stock or bonds.The new common stock can be sold for $60 per share.The bonds can be issued with a 12 percent coupon rate.The firm's existing shares of preferred stock pay dividends of $2.00 per share.The company's corporate income tax rate is 46 percent.The company's balance sheet prior to expansion is as follows: MAX Corporation  a.Calculate the indifference level of EBIT between the two plans.

a.Calculate the indifference level of EBIT between the two plans.

b.If EBIT is expected to be $3 million,which plan will result in higher EPS?

Definitions:

Monocot Roots

The type of roots found in monocotyledonous plants, characterized by a fibrous root system that helps in efficient absorption of water and nutrients.

Eudicot Roots

The roots of eudicot plants, characterized by a central main root from which lateral roots branch out, typically forming a taproot system.

Radicle

The embryonic root of a seed plant.

Apoplast

A continuum consisting of the interconnected, porous plant cell walls, along which water moves freely. Compare with symplast.

Q14: The trade-off associated with holding large amounts

Q70: Accrued expenses represent a spontaneous form of

Q78: Welker Products sells small kitchen gadgets for

Q83: A company collects 25% of its sales

Q93: The tax shield on interest is calculated

Q96: The financial manager selecting one of two

Q99: When an unexpected change in dividend policy

Q126: Brown Inc.needs to borrow $250,000 for the

Q137: If a firm's production process requires high

Q145: Using simulation provides the financial manager with