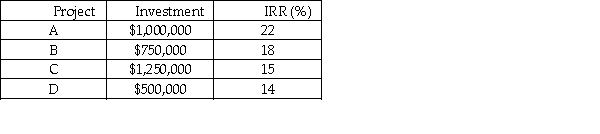

The Clydesdale Corporation has an optimal capital structure consisting of 70 percent debt and 30 percent equity.The marginal cost of capital is calculated to be 14.75 percent.Total earnings available to common stockholders for the coming year total $1,200,000.Investment opportunities are:  a.According to the residual dividend theory,what should the firm's total dividend payment be?

a.According to the residual dividend theory,what should the firm's total dividend payment be?

b.If the firm paid a total dividend of $675,000,and restricted equity financing to internally generated funds,which projects should be selected? Assume the marginal cost of capital is constant.

Definitions:

Natal Nests

The original nests or birthplaces where animals are born and initially raised, often important for species with homing instincts or territorial behaviors.

Brood Parasitism

A reproductive strategy where one species lays its eggs in the nest of another species, leaving the host to incubate and rear the parasitic offspring.

Mate Guarding Hypothesis

A theory explaining certain behaviors intended to prevent sexual access to one’s mate by competitors, ensuring paternity certainty.

Monogamy

A mating system in which an individual has only one mate during a breeding season or for a lifetime.

Q1: A direct quote of $1.6255 dollars to

Q42: Achieving a lower inventory balance through working

Q44: Discretionary financing needed can be positive or

Q44: With regard to the hedging principle,which of

Q51: Many financial managers believe the payback period

Q70: Accrued expenses represent a spontaneous form of

Q95: An asset with an original cost of

Q139: Two advantages of financing with current liabilities

Q146: A significant disadvantage of the internal rate

Q150: Your firm is considering investing in one