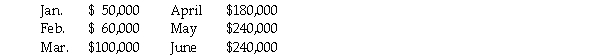

Rawhide Outfitters had projected its sales for the first six months of 2012 to be as follows:  Cost of goods sold is 60% of sales.Purchases are made and paid for two months prior to the sale.40% of sales are collected in the month of the sale,40% are collected in the month following the sale,and the remaining 20% in the second month following the sale.Total other cash expenses are $40,000/month.The company's cash balance as of March 1st,2012 is projected to be $40,000,and the company wants to maintain a minimum cash balance of $15,000.Excess cash will be used to retire short-term borrowing (if any exists) .Fielding has no short-term borrowing as of March 1st,2012.Assume that the interest rate on short-term borrowing is 1% per month.How much short term financing is needed by March 30,2012?

Cost of goods sold is 60% of sales.Purchases are made and paid for two months prior to the sale.40% of sales are collected in the month of the sale,40% are collected in the month following the sale,and the remaining 20% in the second month following the sale.Total other cash expenses are $40,000/month.The company's cash balance as of March 1st,2012 is projected to be $40,000,and the company wants to maintain a minimum cash balance of $15,000.Excess cash will be used to retire short-term borrowing (if any exists) .Fielding has no short-term borrowing as of March 1st,2012.Assume that the interest rate on short-term borrowing is 1% per month.How much short term financing is needed by March 30,2012?

Definitions:

Futures Contracts

Standard legal contracts for purchasing or selling a certain commodity or financial instrument at an agreed upon price at a future date.

Financial Risk

The possibility of losing money on an investment or business venture due to factors like market volatility or borrower default.

Iron Ore

A rock from which metallic iron can be economically extracted.

Copper

A metal element with high thermal and electrical conductivity, widely used in electrical wiring and construction.

Q9: Which of the following is true?<br>A)The forward

Q10: Assume that Federated Stores,whose credit card billings

Q24: The Boyles Ceramics,Inc.established a line of credit

Q26: Which of the following statements would be

Q48: Flashbinder Guitars,Inc.is considering a lockbox system that

Q53: Dividends per share divided by earnings per

Q55: Cash budgets are completed only on an

Q77: Which of the following statements about financial

Q78: Stock repurchases may be used for all

Q161: You have a choice between investing in