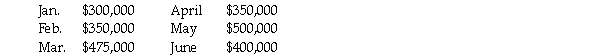

LPD Logistics,Inc.'s projected sales for the first six months of 2010 are given below.  20% of sales are collected in the month of the sale,75% are collected in the month following the sale,and 5% are written off as uncollectible.Cost of goods sold is 80% of sales.Purchases are made the month prior to the sales and are paid during the month the purchases are made (i.e.goods sold in March are bought and paid for in February) .Total other cash expenses are $35,000/month.The company's cash balance as of February 1,2010 will be $30,000.Excess cash will be used to retire short-term borrowing (if any) .LPD has no short term borrowing as of February 28,2010.Assume that the interest rate on short-term borrowing is 1% per month.The company must have a minimum cash balance of $20,000 at the beginning of each month.What is LPD's projected total receipts (collections) for March?

20% of sales are collected in the month of the sale,75% are collected in the month following the sale,and 5% are written off as uncollectible.Cost of goods sold is 80% of sales.Purchases are made the month prior to the sales and are paid during the month the purchases are made (i.e.goods sold in March are bought and paid for in February) .Total other cash expenses are $35,000/month.The company's cash balance as of February 1,2010 will be $30,000.Excess cash will be used to retire short-term borrowing (if any) .LPD has no short term borrowing as of February 28,2010.Assume that the interest rate on short-term borrowing is 1% per month.The company must have a minimum cash balance of $20,000 at the beginning of each month.What is LPD's projected total receipts (collections) for March?

Definitions:

Aggregate Supply

The total supply of goods and services that firms in an economy are willing and able to sell at a given price level in a specific time period.

Long Run Aggregate-Supply

In economics, it represents the total quantity of goods and services that producers in an economy are willing and able to supply at a full employment level, regardless of the price level, over a long period.

Long-Run Equilibrium

A state in which all factors of production are optimally allocated, and firms in a competitive market have no incentive to change their output level or enter/exit the industry.

Expected Price Level

The anticipated average level of prices in the economy for goods and services, often considered in the context of inflation expectations.

Q1: A direct quote of $1.6255 dollars to

Q2: The dividend irrelevance hypothesis is based on

Q15: The U.S.dollar is the most frequently traded

Q21: A quote of .7645 euros per dollar

Q81: Accounts receivable is an asset representing sales

Q91: Interest rate parity theory states that the

Q111: The purpose of maintaining a raw materials

Q128: One component of a firm's financial structure

Q139: Two advantages of financing with current liabilities

Q145: Which of the following has the highest