Returns on Investment

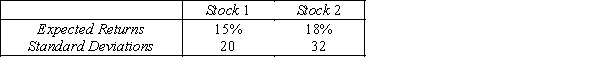

An analysis of the stock market produces the following information about the returns of two stocks.  Assume that the returns are positively correlated with correlation coefficient of 0.80.

Assume that the returns are positively correlated with correlation coefficient of 0.80.

-{Returns on Investment Narrative} Suppose that you wish to invest $1 million.Discuss whether you should invest your money in stock 1,stock 2,or a portfolio composed of an equal amount of investments on both stocks.

Definitions:

Linear Equations

Mathematical equations that make a straight line when graphed, typically in the form of y = mx + b.

Interest Calculation

The process of determining the amount of interest earned or paid over a given period of time.

Graphical Method

A visual way of solving problems or representing data, using graphs and charts to analyze and interpret information, often utilized in mathematics and economics.

Linear Equations

Algebraic equations in which each term is either a constant or the product of a constant and a single variable.

Q1: A sample of size 25 is selected

Q33: A sample of size 25 is selected

Q58: An auto insurance company evaluates many numerical

Q74: Which of the following statements is correct?<br>A)The

Q113: {College Professorship Narrative} If she receives an

Q150: The number of homeless people in Boston

Q164: {Calculus Scores Narrative} What is the probability

Q178: {911 Phone Calls Narrative} Find the probability

Q195: {Equity Loan Rates Narrative} What is the

Q200: If the random variable X is exponentially