Returns on Investment

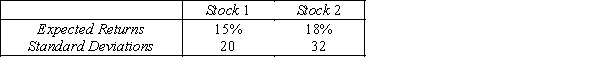

An analysis of the stock market produces the following information about the returns of two stocks.  Assume that the returns are positively correlated with correlation coefficient of 0.80.

Assume that the returns are positively correlated with correlation coefficient of 0.80.

-{Returns on Investment Narrative} Find the standard deviation of the return on a portfolio consisting of an equal investment in each of the two stocks.

Definitions:

Null Hypothesis

A statement postulating that there is no difference or effect, used as a starting assumption in hypothesis testing.

Type I

A statistical error that occurs when a true null hypothesis is incorrectly rejected, also known as a "false positive."

Significance Level

Another term for level of significance, indicating the critical probability level at which the results of a statistical test are deemed significant.

Null Hypothesis

A statement or assumption that there is no significant difference or effect, tested against an alternative hypothesis in statistical analysis.

Q23: {Waiting Time Narrative} What is the probability

Q24: Tanner took a statistics test whose mean

Q30: Initial estimates of the probabilities of events

Q45: A sample of size 25 is selected

Q76: {Golfing Store Narrative} Find the probability distribution

Q95: A random variable X has a normal

Q153: Which of the following statements is correct

Q167: The relative frequency approach to probability uses

Q182: The probability that Z is less than

Q196: If X has an exponential distribution with