Silver Prices

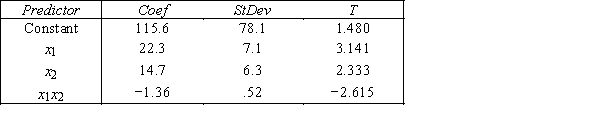

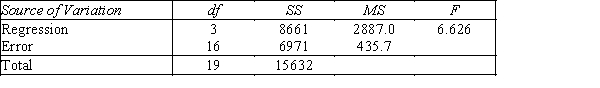

An economist is in the process of developing a model to predict the price of silver.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the first-order model with interaction: y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below. THE REGRESSION EQUATION IS y = 115.6 + 22.3x1 + 14.7x2− 1.36x1x2  S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

-{Silver Prices Narrative} Is there sufficient evidence at the 1% significance level to conclude that the interest rate and the price of silver are linearly related?

Definitions:

Excess Reserves

Excess reserves refer to the capital reserves held by a bank or financial institution in excess of what is required by regulations, guidelines, or central bank requirements.

Individual Bank

A financial institution that deals with consumers and businesses to offer deposit, loan, and investment services on an individual basis.

Discount Rate

The cost in interest that commercial banks and similar storage institutions incur on borrowing from their regional Federal Reserve Bank’s loaning service.

Federal Reserve District Banks

The 12 banks that make up the Federal Reserve System, serving as the central banking system of the United States, each serving a specific geographic district.

Q20: The model y = β<sub>0</sub> + β<sub>1</sub>x<sub>1</sub>

Q24: The term "seasonal variation" may refer to:<br>A)systematic

Q45: Which of the following shows the calculation

Q77: If we have 5 years of monthly

Q91: A multiple regression model involves 5 independent

Q91: In order to predict with 98% confidence

Q92: Because of multicollinearity,the t-tests of the individual

Q96: The easiest way of measuring the long-term

Q125: The model y = β<sub>0</sub> + β<sub>1</sub>x<sub>1</sub>

Q147: If data for a time series analysis