Silver Prices

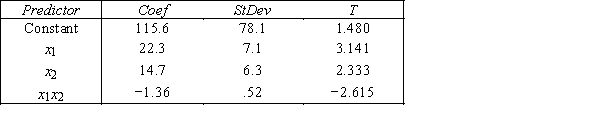

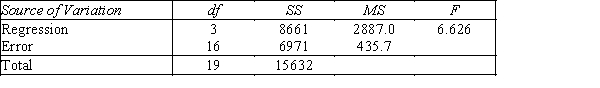

An economist is in the process of developing a model to predict the price of silver.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the first-order model with interaction: y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below. THE REGRESSION EQUATION IS y = 115.6 + 22.3x1 + 14.7x2− 1.36x1x2  S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

-{Silver Prices Narrative} Is there sufficient evidence at the 1% significance level to conclude that the interaction term should be retained?

Definitions:

Pre-Packaged Bankruptcy

A plan for financial reorganization that a company prepares in cooperation with its creditors before filing for bankruptcy.

Unlevered Cost of Capital

The cost of capital for a company without any debt, reflecting the required return on equity and investment without the impact of financial leverage.

Cost of Equity

The return a company is expected to provide to its shareholders to compensate them for the risk of investment.

Debt

An amount of money borrowed by one party from another, typically for large medium or long-term financial projects, with an obligation to pay back with interest.

Q13: In reference to the equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4388/.jpg"

Q15: Suppose that the sample regression line of

Q19: Consider the following statistics of a multiple

Q36: If the coefficient of correlation is 1.0,then

Q54: The model <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4388/.jpg" alt="The model

Q58: If the time series displays a gradual

Q84: In determining monthly seasonal indexes for gas

Q122: The Friedman test is always:<br>A)one-tail with >

Q144: {Frozen TV Dinner Narrative} Which statistical technique

Q218: {ebay Storefront Sales Narrative} Plot the percentage