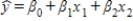

The model  is used whenever the statistician believes that,on average,y is linearly related to x1 and x2 and the predictor variables do not interact.

is used whenever the statistician believes that,on average,y is linearly related to x1 and x2 and the predictor variables do not interact.

Definitions:

Forward Contract

A financial contract between two parties to buy or sell an asset at a specified future time at a price agreed upon at the contract's inception.

Settlement Date

The date on which a trade (purchase or sale of securities) is finalized, and the buyer must make payment while the seller delivers the securities.

Zero Sum Game

A situation in finance or economics where each participant's gain or loss is exactly balanced by the losses or gains of the other participants.

American Call Option

An option contract that gives the holder the right, but not the obligation, to buy an underlying asset at a specified price within a set period, anytime until the contract's expiration.

Q3: Discuss two indicators that can be found

Q12: It is not possible to incorporate nominal

Q44: Which test(s)can you use when you want

Q55: {Student's Final Grade Narrative} Does this data

Q60: The parameter estimates are biased when multicollinearity

Q74: {Quarterly Sales Narrative} Graph the time series

Q126: A multiple regression model has the form

Q167: {Liquor Sales Narrative} Exponential smoothing with a

Q189: The results of a quadratic model fit

Q229: If the coefficient of correlation is −0.81,then