Silver Prices

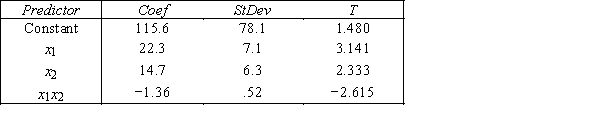

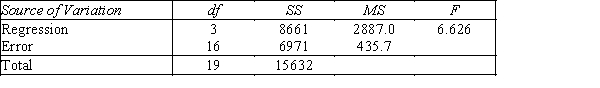

An economist is in the process of developing a model to predict the price of silver.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the first-order model with interaction: y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below. THE REGRESSION EQUATION IS y = 115.6 + 22.3x1 + 14.7x2− 1.36x1x2  S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

-{Silver Prices Narrative} Is there sufficient evidence at the 1% significance level to conclude that the interest rate and the price of silver are linearly related?

Definitions:

Security Market Line

A graphical representation that shows the expected return of an asset at different levels of systematic, or market, risk.

Market Rate

The current interest rate available in the marketplace for securities or loans.

Risk-free Rate

A theoretical return on an investment with zero risk, typically represented by government bonds.

Portfolio Beta

A measurement of the volatility of a portfolio compared to the market as a whole.

Q9: The Spearman rank-correlation coefficient can only take

Q14: {Advertisement Narrative} Conduct the test at the

Q41: {Coffee Imports Narrative} Use the regression technique

Q46: {Oil Quality and Price Narrative} Which interval

Q54: An estimated second-order autoregressive model for average

Q64: {Liquor Sales Narrative} A centered 5-year moving

Q73: The population Spearman correlation coefficient is labeled

Q145: {Accidents and Rain Narrative} Estimate the number

Q169: {Frozen TV Dinner Narrative} Using the appropriate

Q224: Given the following time series,compute the seasonal