Silver Prices

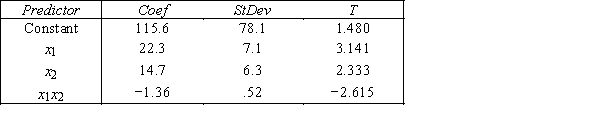

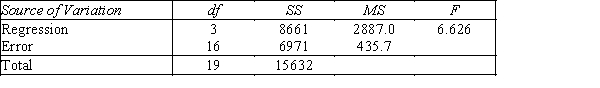

An economist is in the process of developing a model to predict the price of silver.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the first-order model with interaction: y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below. THE REGRESSION EQUATION IS y = 115.6 + 22.3x1 + 14.7x2− 1.36x1x2  S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

-{Silver Prices Narrative} Is there sufficient evidence at the 1% significance level to conclude that the interaction term should be retained?

Definitions:

Supply Shifts

Changes in the supply curve caused by factors other than the product's price, such as production costs, technology, and expectations, leading to more or less of the product being supplied at each price.

Equilibrium Quantity

The amount of goods or services supplied in a market that is exactly equal to the quantity demanded at the equilibrium price.

Rationing Device

A method used to distribute scarce resources, goods, or services among people.

Supply Shifts

Movements of the supply curve to the right or left, indicating a change in the quantity supplied at each price point, due to factors other than the price of the good itself.

Q19: If the coefficient of correlation is −0.60,then

Q26: {Life Expectancy Narrative} What is the adjusted

Q48: Multicollinearity is present when there is a

Q50: Discuss briefly the procedure that is employed

Q53: If a time series displays a gradual

Q89: {Game Show Winnings & Education Narrative} Determine

Q115: The alternative hypothesis for the Friedman test

Q135: {Student's Final Grade Narrative} What is the

Q206: The easiest way of measuring the long-term

Q297: {Oil Quality and Price Narrative} For what